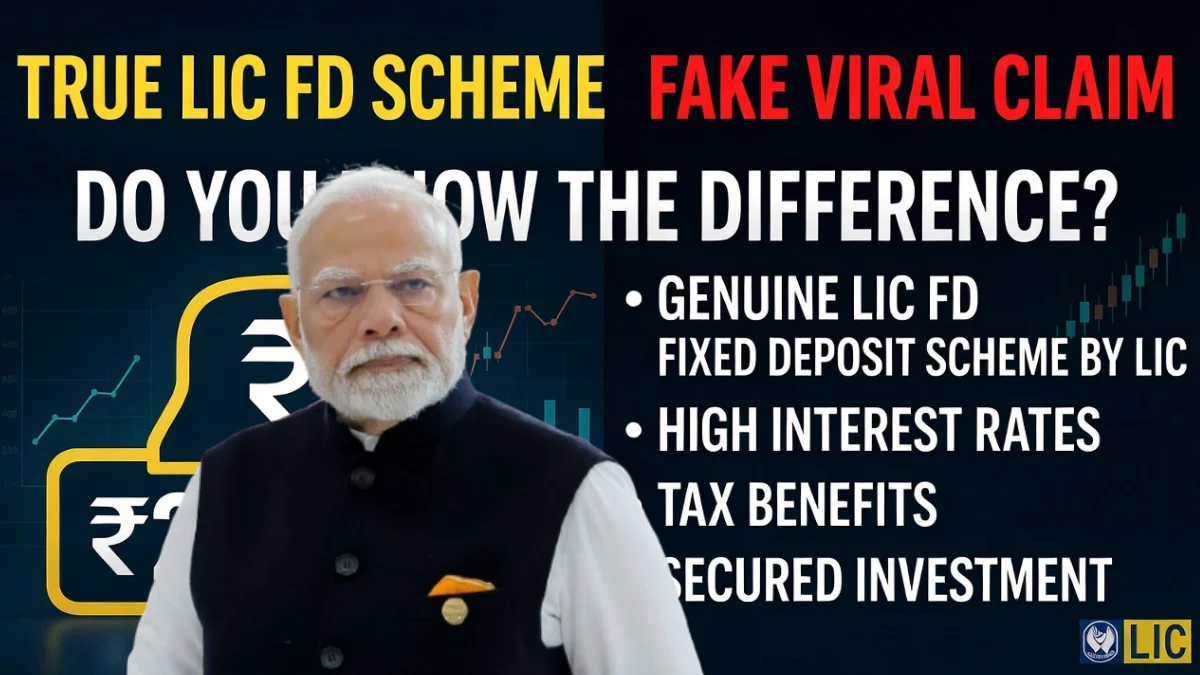

A sudden buzz on social media recently claimed that LIC has launched a new FD scheme in 2026 where investors can deposit ₹2 lakh and receive ₹6,736 every month. Because LIC is one of India’s most trusted financial institutions, thousands of people started searching online to verify this news. However, after checking official information, regulatory updates, and verified LIC disclosures, it becomes clear that this viral message is completely false. LIC has not launched any FD scheme offering such high monthly returns, and no official announcement supports the claim.

Although the circulating number is misleading, LIC’s actual fixed deposit options under LIC Housing Finance Ltd. (LIC HFL) remain popular among investors who prefer stability and predictable income. Therefore, it becomes important to highlight the correct facts and ensure that investors make decisions based on accurate and safe information rather than misleading viral content.

What Is the LIC FD Scheme in Reality?

The LIC FD Scheme, officially called the Sanchay Public Deposit Scheme, is provided by LIC Housing Finance Ltd, a subsidiary of the Life Insurance Corporation of India. It is a regulated fixed deposit program designed for individuals who seek low-risk, guaranteed returns.

Key features of LIC HFL FDs include:

-

Regulated by the National Housing Bank

-

Fixed and assured interest returns

-

Tenure options ranging from 1 to 5 years

-

Monthly, quarterly, and annual interest payout choices

-

Higher interest rates for senior citizens

-

Minimum deposit starting from ₹10,000

-

Fully transparent deposit process

Because of LIC’s reputation, many risk-averse investors consider this FD one of the safest options in the market.

The Viral Message of Earning ₹6,736 Monthly Is Fake

The most important clarification is that the claim stating “Invest Rs 2 lakh and earn ₹6,736 monthly” is not supported by LIC, LIC Housing Finance, or any regulatory body. No FD in India offers such high payout on a small deposit amount because the required interest rate would be unrealistically high.

To put this in perspective, consider this simple calculation:

-

To earn ₹6,736 monthly, the annual payout would be more than ₹80,000.

-

On an investment of ₹2 lakh, this would require an interest rate above 40 percent annually, which is not offered by any regulated financial institution in India.

Therefore, the viral message does not match any logical or regulatory standards. It appears to be fabricated content designed to attract attention without providing verified data.

Realistic Monthly Income From a ₹2 Lakh LIC FD

To understand the actual expected monthly income, let us consider a moderate LIC HFL FD interest rate of 7 percent per annum, which aligns with historical rate trends. Although rates change from time to time, this example gives a fair idea of real returns.

Correct Calculation

-

Interest per year: ₹2,00,000 × 7 percent = ₹14,000

-

Interest per month: ₹14,000 ÷ 12 ≈ ₹1,166

Therefore, the realistic monthly income from a ₹2 lakh LIC FD ranges between ₹1,100 and ₹1,200, depending on the exact FD rate and tenure chosen.

This calculation clearly demonstrates that the viral figure of ₹6,736 per month is not only false but financially impossible based on regulated interest rates in India.

Why Investors Must Verify Financial Claims

Because financial misinformation spreads quickly through social media and messaging apps, investors should always double-check:

-

Official announcements

-

Verified websites

-

Regulatory disclosures

-

Actual interest rate documents

Before depositing any amount, it is crucial to confirm details through trusted platforms. LIC Housing Finance maintains updated rate charts and formal announcements only on its official website.

- Official LIC Housing Finance Website:

https://www.lichousing.com/

This is the only authentic source for LIC FD interest rates and scheme details.

Benefits of the LIC FD Scheme in 2026

Even though the viral claim is false, the real LIC FD scheme remains a safe investment option. It offers:

-

Guaranteed and stable returns

-

No market volatility

-

Predictable monthly or quarterly income

-

Reliable service backed by LIC Housing Finance

-

Easy deposit process through branches and online platforms

Because many investors today look for stable alternatives during periods of market uncertainty, the LIC FD scheme continues to attract strong interest.

Who Should Consider the LIC FD Scheme?

This FD scheme is particularly suitable for:

1. Senior citizens

They prefer monthly income and want reliable returns without market dependency.

2. Conservative investors

Individuals who do not want to risk their savings in equities or mutual funds.

3. Retirees and homemakers

People looking for steady cash flow without complicated investment conditions.

4. Young professionals building a safe portfolio

Those beginning long-term planning often allocate a portion of funds to FDs.

5. Families needing fixed savings for future goals

FD maturities can support education, emergency funds, and planned purchases.

Because the scheme is simple, regulated, and transparent, it appeals to a wide range of investors.

Important Points to Understand Before Investing

Before choosing an LIC FD, investors must keep in mind:

-

FD interest is taxable under Indian income-tax laws

-

Premature withdrawals may incur penalties

-

FD rates change periodically

-

Investment decisions should be based on verified documents only

-

Viral messages should not guide financial choices

By following these guidelines, investors can protect their money and avoid misleading information.

How to Apply for the LIC FD Scheme

Investors can apply through:

-

LIC Housing Finance official website

-

LIC HFL branch offices

-

Authorised agents

-

Registered financial service providers

Required documents usually include:

-

Identity proof

-

Address proof

-

PAN details

-

Passport-size photograph

Once the application is processed and the deposit is made, the investor receives a formal FD receipt.

Conclusion

The claim that LIC has launched a new FD scheme in 2026 offering ₹6,736 per month on a ₹2 lakh deposit is entirely false. No official LIC or LIC Housing Finance announcement supports this. However, LIC’s real FD scheme through LIC Housing Finance remains a credible and dependable investment choice. It provides fixed returns, regulated oversight, flexible tenures, and monthly payout options for investors who value stability.

As financial misinformation continues to spread quickly, it is essential for investors to rely only on verified sources and official websites before making decisions. For accurate updates, interest rates, and eligibility guidelines, always refer to:

For More Information Click HERE